#2 CFOs can turn AI into their 24/7 partner

Ready to use prompts for CFOs to get ahead

Yesterday, ChatGPT released its new models (o3 and o4 Mini).

And I got to it and started figuring out how CFOs can use them.

The new ChatGPT models didn’t get smarter. They just got more useful.

The old AI was like putting a team of PhDs and locking them in a room with no tools.

They can read, but they can’t use a calculator, access the internet, or write on a whiteboard.

But what if you give them access to Excel, Python, charts, and Google?

That’s what the new ChatGPT models (o3 and o4 Mini) just unlocked.

Same intelligence. But now they can act.

And for CFOs, that changes everything.

OpenAI’s Latest Models Are Now Autonomous Agents with Tools

They can:

Use calculators

Write code

Browse the web

Understand images

Generate visual reports

Remember past prompts (thanks to memory)

And most importantly? They know when to use which tool to solve a problem.

That’s the shift.

The model doesn’t just answer your question. It figures out how to get the answer using whatever resource it needs.

You’re no longer talking to a chatbot. You’re working with a full-stack virtual analyst.

Consider today’s letter a forbidden playbook with ready-to-use prompts.

2 Deadly CFO AI Use Case

1. Your Board Deck, Built Inside ChatGPT

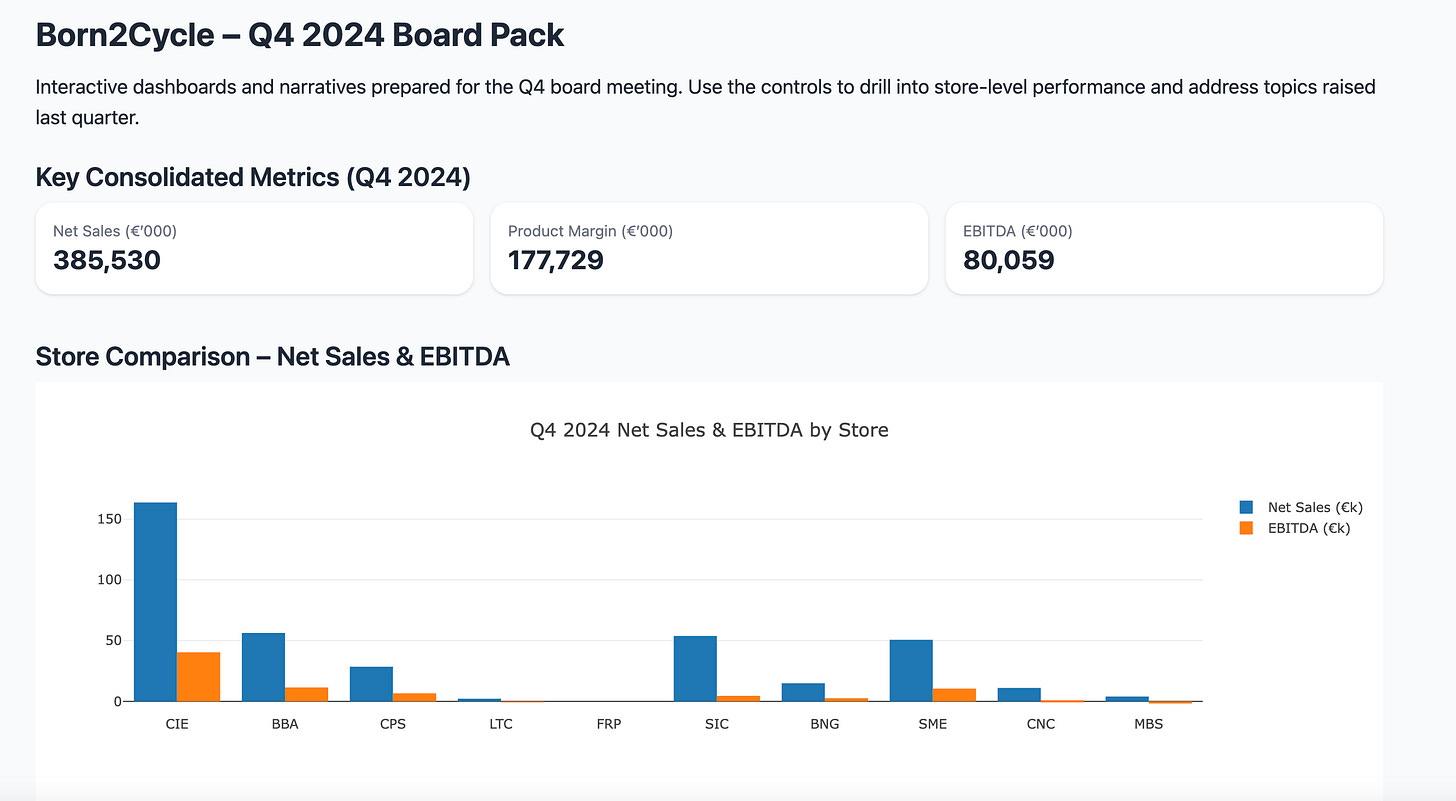

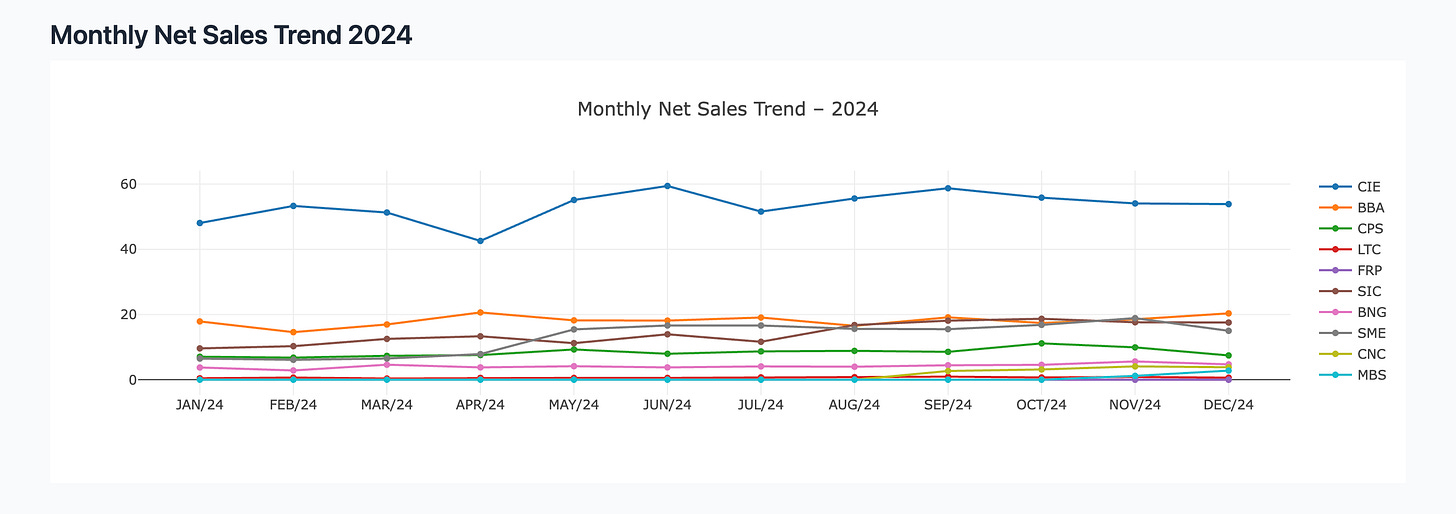

I uploaded the financials and a past board transcript to ChatGPT using model o3.

It has deep, multi-step reasoning.

The result?

A live dashboard

Draft board commentary

Key insights auto-generated

All done in minutes.

No Excel. No design work. No slide prep. Just a prompt.

I didn’t need a team to compile the story. The AI did it.