2 reasons why every CFO must be excited about AI Agents

Here’s my advice on AI (and what I’d tell my team):

Every finance person must be excited about AI Agents (2 reasons why).

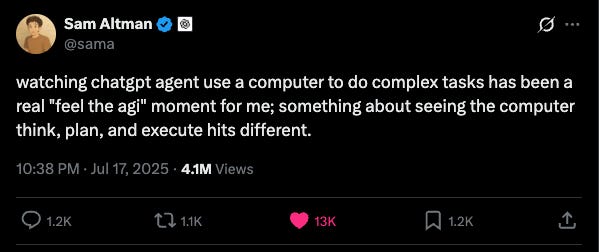

1. AI Agents actually get things done.

ChatGPT Agent isn’t like Gemini, Grok, or Claude. It doesn’t just talk.

It logs into your systems, finds files, matches transactions, drafts emails, and prepares reports. Throw it messy ERP exports and it sorts them out. Feed it raw data, and it bu…