2026 CFO Playbook

CFO confidence hits a 4-year high. Here are 5 moves CFOs must make to change the finance function.

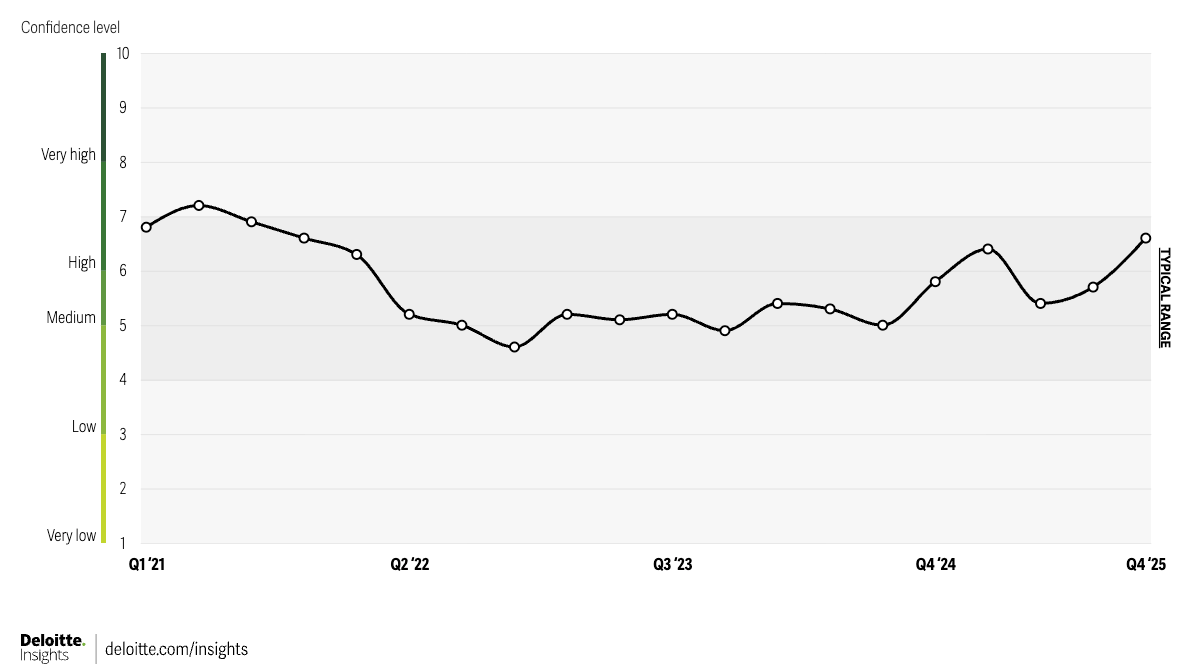

CFO confidence hits a 4-year high.

Historically, this is not when finance errors disappear.

It is when they become more expensive.

You can feel it already.

The CEO wants confidence.

The board wants momentum again.

The numbers look stable enough to relax.

And the market is rewarding companies that sound certain.

That’s exactly why 2026 is dangerous.

Misallocation…