3 AI use cases in Accounting, AR, and AP

I sat down with 3 founders building inside finance’s hardest, messiest problems.

Every CFO I speak to is ready to spend on AI. The budget is there. The board expectation is there. The pressure to do something with AI is real.

And yet, finance is still stuck.

The close still runs late. Cash still hides in AR. AP still breaks the moment reality doesn’t match the system. This is because most CFOs are pushed to start in the wrong place.

The market talks about AI at the top of the stack:

Chatbots.

Dashboards.

Forecasting layers.

But finance doesn’t fail at the top.

It fails where transactions meet reality.

Instead of reviewing AI products, I sat down with 3 founders building inside finance’s hardest, messiest problems. Each founder is attacking a different bottleneck:

Accounting judgment.

Cash timing.

Invoice chaos.

They aren’t using AI to replace your team.

They are using it to remove the document archaeology your team must never have performed in the first place.

Here are 3 big finance problems that AI solved, which every CFO must understand.

Let’s dive in.

1. Accounting

If the system doesn’t understand the transaction, automation just helps you be wrong faster.

Accounting software was built to record outcomes, not to understand transactions. That design choice explains why automation has disappointed for 30 years.

A real transaction doesn’t arrive as a clean data row.

It arrives as a bank movement, a messy invoice, or a contract clause that changes timing. Traditional systems, like NetSuite or QuickBooks, force humans to manually bridge that gap.

But Modern tools like Puzzle don’t start with the journal entry. They start with the transaction’s behavior. Instead of asking where something should post, the system asks:

What actually happened economically?

It pauses to show its reasoning before anything touches the ledger.

Innovation is happening outside the ledger because legacy APIs were designed for data in, not judgment applied.

You can’t add reasoning onto systems designed only to store outcomes.

Stop trying to fix your ledger with bots.

Build an intelligence layer above it.

2. Accounts Receivable

Collections break when you treat every customer like the same problem.

Most AR systems assume that if you send the right reminder, cash will arrive. They are wrong. Late payments are rarely about memory; they are about context, disputes, internal approvals, or invoices that don’t match the customer’s records.

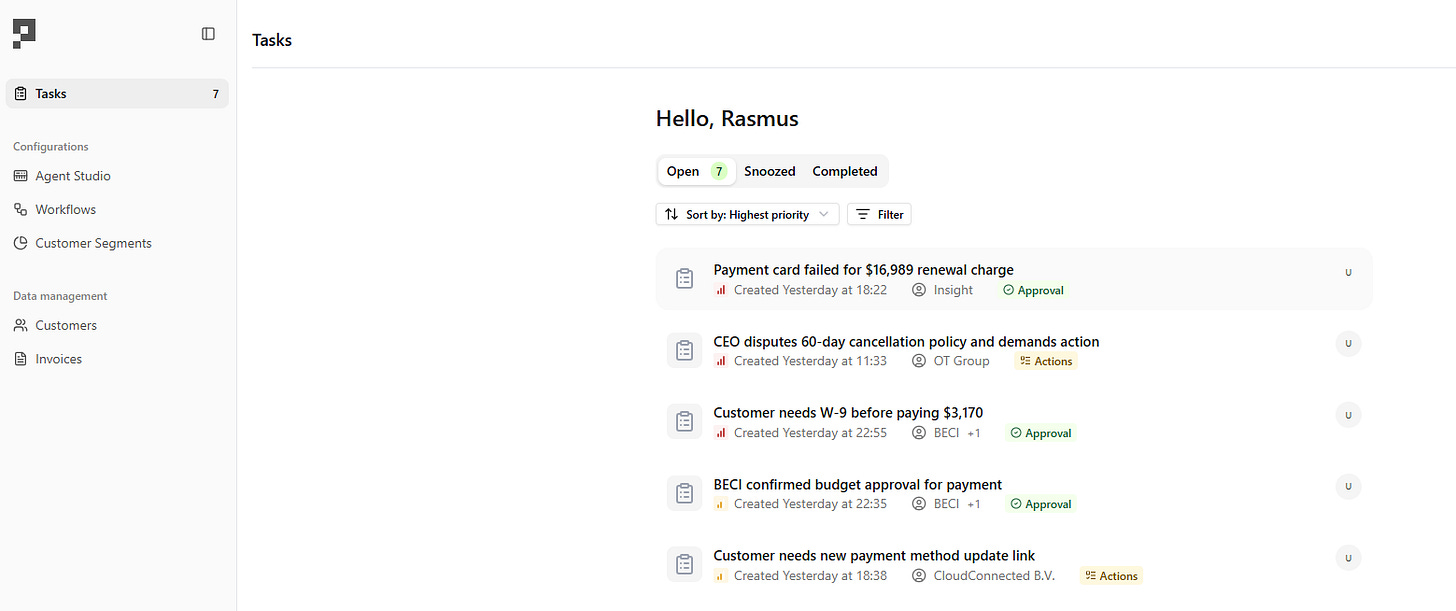

Paraglide reframes the problem. Instead of automating reminders, it automates decision points. Its AI agents:

They read inbound emails to distinguish a dispute from a delay.

They adjust follow-ups based on customer behavior, not static 30/60/90-day rules.

AR should not be a reporting function.

It should be a judgment layer sitting between customer behavior and cash outcomes.

Earlier clarity leads to lower DSO.

3. Accounts Payable

The ledger should be protected, not cleaned.

AP systems fail because they assume a perfect world where invoices match POs.

Reality includes partial deliveries, split shipments, and human negotiation embedded in PDFs. Most software handles these as exceptions for humans to clean up later.

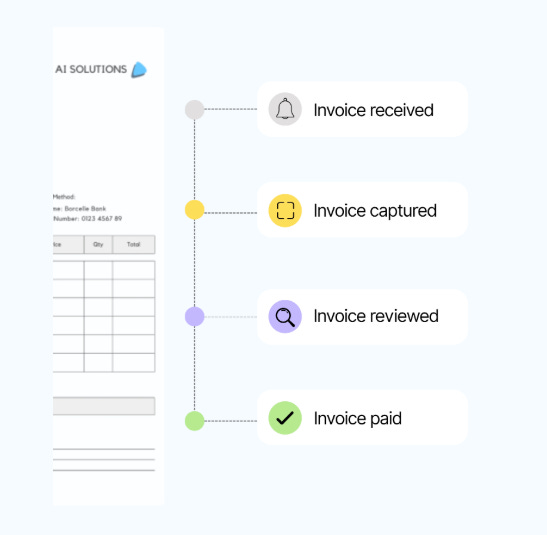

Dost starts from a different premise… Invoices don’t create problems.

They expose where reality diverged from expectation.

It matches line items across invoices, POs, and delivery notes.

It isolates discrepancies and routes them for correction before they hit the ERP.

Most systems absorb noise and reconcile it later.

The next generation prevents noise from entering at all.

The payoff isn’t just speed.

It’s a ledger you can actually trust.

The Bottom Line

Across accounting, AR, and AP, the pattern is the same.

AI works in finance only when it sits before finality.

Before posting, recognition and balances harden.

When AI reasons about context, shows its logic, and pauses for human confirmation, it builds trust. The last generation of finance software optimized for storage.

The next generation is being built around verification.

If you want to impress the CEO and the Board… Don’t start with a pilot.

Start with your architecture.

Because once finance stops cleaning up after its systems, AI finally starts compounding instead of distracting.

AI is great, but it won’t work if your data is a mess.

Fix that first.

And that’s all for today.

See you on Thursday!

P.S. Connect on LinkedIn with Sasha (Puzzle), Rasmus (Paraglide), and Adam (Dost)

Whenever you’re ready, there are 2 ways I can help you:

If you’re building an AI-powered CFO tech startup, I’d love to hear more and explore if it’s a fit for our investment portfolio.

I’m Wouter Born. A CFOTech investor, advisor, and founder of finstory.ai

Find me on LinkedIn