AI is changing the CFO role... but how? (deep dive)

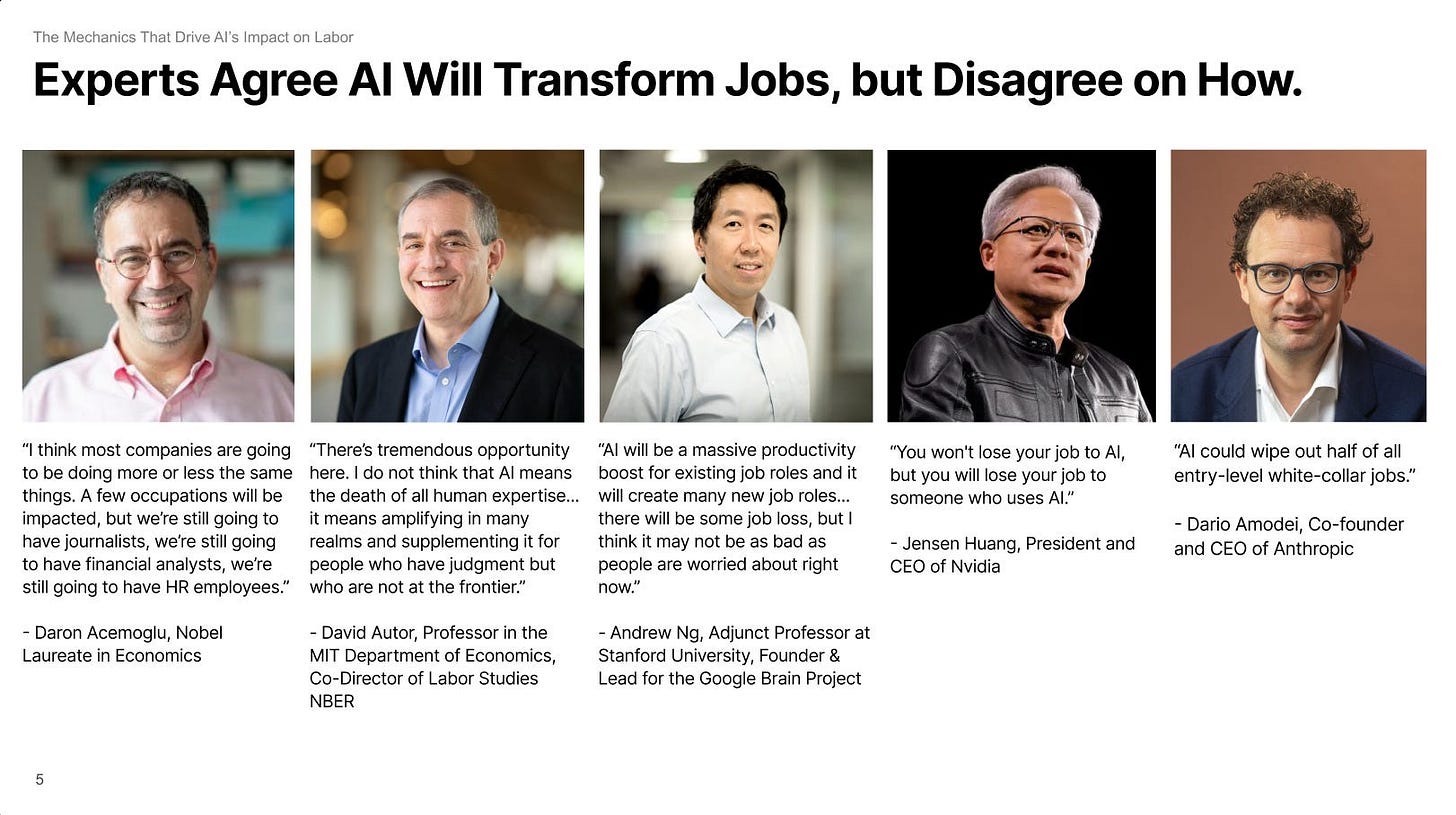

Top experts say AI will change the $18.6 trillion labor market... but how?

Every expert is screaming that AI will change every role. But if you’re a CFO looking at your P&L, you’re probably asking: When?

The latest Duke CFO Survey warns a majority of CFOs are seeing zero AI impact on:

Labor productivity.

Customer satisfaction.

Decision-making speed.

Time spent on high-value work.