CFO's AI Action Plan

Imagine it’s 2035. Finance teams are gone.

Imagine it’s 2035. Finance teams are gone.

No accountants. No FP&A analysts. No controllers.

Just you and 10,000 AI agents running finance in real-time.

The books close themselves instantly. Cash flow is optimized before you even ask. Forecasts adjust automatically with live market data.

No more SaaS vendors.

No more vendor negotiations.

No more procurement headaches.

FP&A vendors pivot to selling “AI-optimized strategy consulting,” but no one buys because AI handles that too. Why pay for software when your AI agents build what you need on demand?

Need a new FP&A model? Agent-4821 designs it in seconds. Regulatory change? Agent-7734 updates compliance in real time. Board report? AI assembles the slides before you wake up. Finance runs itself.

No audits.

No errors.

No manual work.

But when every CFO has the same tools, the same perfect AI models…

What sets them apart?

Strategy.

Influence.

Judgment.

Relationships.

Real-world intuition AI can’t replicate.

In this edition of the CFOs AI Action Plan, I’ll go beyond theory to give you actionable insights, real-world examples, and frameworks from leading CFOs and companies.

Growth of AI and CFO Tech Stack

AI's capabilities are growing fast. For example:

AI models like Anthropic's systems are nearing the performance of top specialists in coding and mathematics.

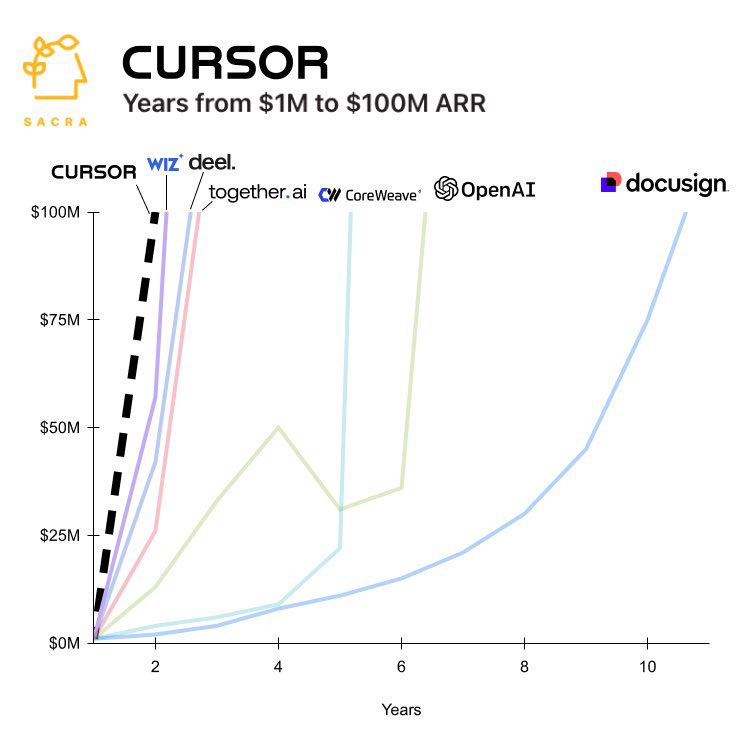

Companies like Cursor have scaled to $100M in revenue faster than any software company before them, driven by AI-powered development tools.

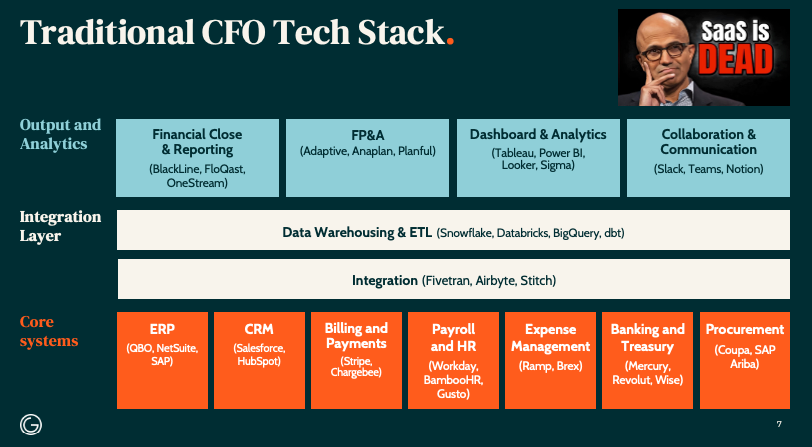

The traditional CFO tech stack is siloed and inefficient

Core systems (ERP, CRM, billing) feed into integration layers (data warehousing, ETL tools).

Output layers (FP&A tools, dashboards) require manual intervention.

Agentic AI replaces this with a centralized "finance data warehouse" where autonomous agents handle processes like accounts payable/receivable, treasury management, and compliance.

Traditional Stack: Layered architecture requiring human intervention.

Agentic Stack: A unified system with autonomous agents managing end-to-end processes.

Only a small fraction of CFOs feel their teams are truly prepared to leverage AI.

Deloitte says, fewer than 20% of CFOs say their teams have a clear AI strategy, even though 42% plan to invest significantly in AI this year.

The CFO must stop working like a chief Accounting officer.

And start leading as chief value officer.

CFO’s AI Action Plan

AI can’t be plugged in overnight. It needs a plan.

Here’s how to integrate AI in finance.