How to master AI in finance

After talking to top 5 CFOs about AI, here's what shocked me

I had a conversation with a CFO in January:

He runs finance for a $400M company.

Sharp. Experienced. Trusted by his board.

I asked him what his team was doing with AI.

He paused.

I know AI matters. My board knows it matters. But I don’t know where to start, and I don’t have time to figure it out.

I’ve had that same conversation. But different words, same fear… with 5 CFOs since last year. Different industries. Different company sizes. Same paralysis.

They’re stuck.

And while they’re stuck, the world is moving without them.

Today I’m sharing the 5 patterns I saw across every conversation… what separates the CFOs who figured AI out from the ones still figuring out.

If you’re just getting started or already deep in AI, this might surprise you.

And you’ll definitely catch up with AI.

Let’s dive in.

1) Your Auditors are Ahead of You

A CFO told me this in March.

My EY audit team is using AI agents. My team is still copy-pasting into Excel.

He wasn’t exaggerating.

EY deployed 150 AI agents supporting 80,000 professionals this year. Not a pilot. Production. Processing 3 million tax compliance outcomes. Redefining 30 million tax processes. Annually

And they weren’t alone:

Deloitte launched Zora AI … projecting 25% cost reduction and 40% productivity gains.

KPMG launched Workbench.

A multi-agent collaboration platform for audit.

PwC scaled its own agentic AI platform.

All four Big 4 firms shipped AI agent platforms in the same year.

The people who audit your books are running AI workflows that flag anomalies, process documents, and make decisions without constant human oversight.

CFOs think they have at least two more years before this gets real.

You don’t.

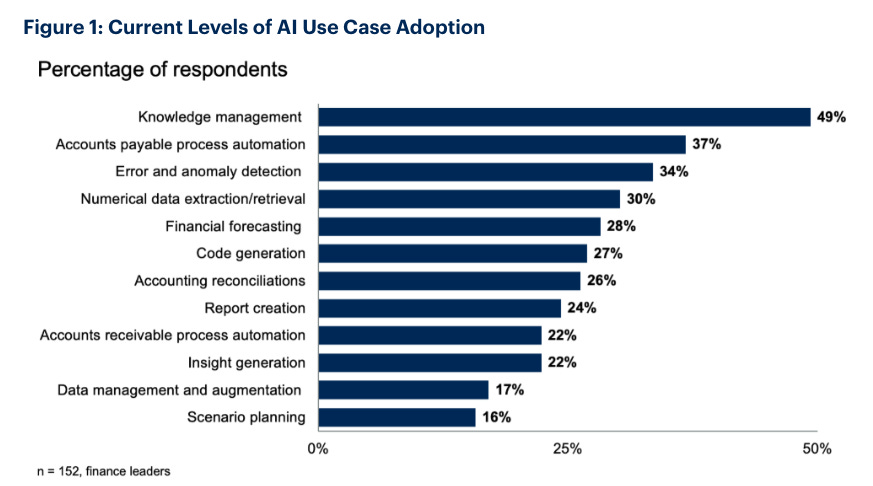

2) The Adoption Curve Flatlined

That’s the part nobody’s talking about

Everyone assumes AI adoption in finance is accelerating. It’s not.

According to Gartner’s 2025 AI in Finance Survey:

2023: 37% of finance functions used AI.

2024: 58%.

2025: 59%.

One percentage point. Flatline.

CFOs try new tools and it kind of works out. But nobody knows what to do next. That’s the story I heard everywhere. A pilot gets launched. Shows promise. But the data isn’t clean enough. The team doesn’t have the skills. Nobody owns it.

So it dies quietly in a folder nobody opens.

Deloitte’s Q4 2025 CFO Signals survey found that 87% of CFOs say AI will be critical to their finance operations in 2026.

Only 2% say it won’t matter.

Everyone agrees it matters. Almost nobody is doing anything about it.

And the few who are? They’re pulling away fast.

A CFO I spoke with last year. I asked what he did differently. His answer was almost disappointing in its simplicity.

We didn’t do anything exotic. We just didn’t stop after the first pilot.

3) What AI CFOs Do Differently

Across every conversation, 3 patterns kept repeating.

Not one CFO who was ahead did all 3 deliberately from day one. But looking back, every single one followed this path.

1. They started with one workflow

Every CFO who stalled started with a 30-page AI strategy, a vendor evaluation, or a board presentation about transformation.

Every CFO who moved started with one task. Usually something painful and repetitive that nobody wanted to do.

One CFO started with invoice processing. Eight hours a week, zero strategic value.

We automated that first. It worked. So we did the next thing. Then the next. That’s how it happened. Not with a strategy. With momentum.

Another described it as building in layers… triaging first, then summarization, then the workflow in the middle, then full automation. Bit by bit as the data got better and the trust grew.

AI scales in finance the same way it scales everywhere.

Not top-down. Not all at once. One workflow at a time.

2. They learned the tools themselves

This one surprised me more than anything.

Every CFO who is actually ahead, not talking about being ahead but actually ahead, had opened the tool themselves. Not their team. Not IT. Not a consultant. Them.

One spent two weeks learning Claude before he asked his team to try it.

I couldn’t lead something I didn’t understand. So I just started prompting. It was messy. But I learned what was possible.

It’s actually pretty quick to go from novice to expert because of how new this all is.

You immerse yourself for a bit and you see things you can do that you didn’t even think about before. You can’t evaluate what AI does if you’ve never used it.

You can’t set a vision for AI in finance if your only reference point is a vendor pitch.

3. They stopped calculating and started validating

A CFO at a dinner in June said something I’ve been quoting ever since.

My job isn’t to calculate anymore. My job is to ask.. does this make sense?

AI handles the computation. It builds the variance commentary. Generates the dashboard. Models the scenarios.

What it can’t do is judgment.

Knowing which variance matters. Knowing which trend is signal versus noise. Knowing the data says one thing but the business reality says another.

Anyone can ask AI to summarize my financials.

But if you don’t have the domain expertise to know the answer is wrong, you’re making decisions off average data and a generic AI response.

Garbage in, garbage out didn’t disappear with AI.

It got more dangerous. Because now the garbage comes back beautifully formatted with charts. The skill that will define the next generation of finance leaders isn’t prompt engineering. It’s not coding.

It’s knowing what to ask.

And knowing when the answer doesn’t make sense.

4) Finance Jobs will Shrink

You need to pick a lane.

This came up in almost every conversation.

Finance is dividing into 2 lanes:

Lane one

Financial control.

Governance. Retrospective. Making sure the numbers are right. This lane is being automated fast. The human role is shifting to oversight… making sure the technology gets it right.

Lane two

Strategic finance.

FP&A. Prospective. Resourcing the plan. Building business cases. Partnering across the business to execute strategy.

The finance leader of the future isn’t the person who knows all the answers. They’re the person who enables everyone else to make better financial decisions.

The tools are democratizing financial data.

Non-finance people can now ask questions and get answers. The CFO’s role isn’t to gatekeep that. It’s to make sure the data underneath is good enough that those answers are trustworthy.

And the hiring is changing to match.

Every CFO I asked said the same thing about what they look for now.

Curiosity. Above everything.

The candidate of the future is less focused on knowing the answer and more focused on how to find it.

You can teach someone accounting standards.

But you can’t teach someone to care about doing things better.

5) Margins are Thinning

This isn’t optional anymore.

Every CFO I speak to.. every industry, every size says the same thing. Margins are narrowing. Less buffer. Less room for mistakes. Just 3 years ago you could absorb a bad quarter. That buffer is gone. Everything has to be tighter now.

In that environment, AI isn’t a technology conversation.

It’s a margin conversation.

The teams that automate the repetitive work free their people for strategic work. The teams that don’t have expensive people doing manual tasks that a machine does better and faster.

And the distance between stuck and started is shorter than you think.

You don’t need a strategy deck. You don’t need a vendor evaluation. You don’t need board approval.

Pick the task your team hates most.

The one that eats hours every month and adds zero strategic value.

Open Claude or ChatGPT. Upload the file. Ask it to do the work.

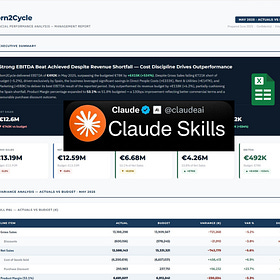

Claude Skills for CFOs, one setup. Consistent dashboards. Forever

I once watched a CFO build a dashboard.

It won’t be perfect. Iterate. Push back. Treat it like a sharp new analyst who needs direction. When you get output you like, save the prompt. Use it next month. Build on it.

That’s how every CFO I talked to started.

Not with a plan. With curiosity.

The Bottom Line

87% of CFOs say AI matters.

Only 13% have the infrastructure to act on it.

The Big 4 are already running AI agents in production.

And adoption flatlined at 59%.

The gap isn’t between believers and skeptics. It’s between the CFOs who opened the tool and the ones still waiting for a strategy deck.

Every CFO who figured it out started with one workflow, learned the tool themselves, and focused on judgment over calculation.

The window to catch up is still open.

But it’s closing faster than most finance leaders think.

You can start this week.

All you need is one task, one tool, and one prompt.

That’s all it takes to stop being stuck.

And that’s all for today.

See you on Thursday.

Whenever you’re ready, there are 2 ways I can help you:

If you’re building an AI-powered CFO tech startup, I’d love to hear more and explore if it’s a fit for our investment portfolio.

I’m Wouter Born. A CFOTech investor, advisor, and founder of finstory.ai

Find me on LinkedIn