How to use GPT-5 in finance (evidence-based)

2 GPT-5 Prompts for Saas Finance Dashboard + MRR forecast

GPT-5 is here and it’s powerful.

OpenAI calls it their smartest, fastest, and most useful model yet.

For the first time, a single model blends instant responses with deep reasoning, switching between quick outputs and long-form expert analysis depending on the complexity of your question.

Every CFO and finance leader must know how to use GPT-5.

Here’s why:

400,000-token context window → Upload entire ERP exports, board decks, or policy documents and ask complex questions without breaking them into chunks.

45% lower hallucination rate vs GPT-4.0 → Fewer fact errors, more reliable analysis.

80% fewer reasoning errors when using thinking mode → Better for scenario planning and sensitivity analysis.

Faster execution → Handles complex calculations, reconciliations, and coding tasks in seconds.

I know GPT-5 doesn’t solve every finance pain.

But you must see superintelligence through the fog. You don’t have the road, fuel, or rules fully in place. That’s the truth and the frustration. But it’s on us finance builders, operators and parents to meet the moment with judgment, not slogans.

Jobs are getting squeezed.

Entry-level roles: some vanish; many compress.

Young builders: the best moment in history to ship alone and scale.

Late-career workers: the real risk. Retraining sounds noble, but it feels punishing.

GPT-5 lets you build faster than you can imagine. And you don’t need anybody’s permission to build and experiment.

In today’s edition, I’ll show you how GPT-5 can complete complex FP&A tasks in minutes… work that once took hours or days. I tested 2 impressive prompts for CFOs, both impossible in GPT-4:

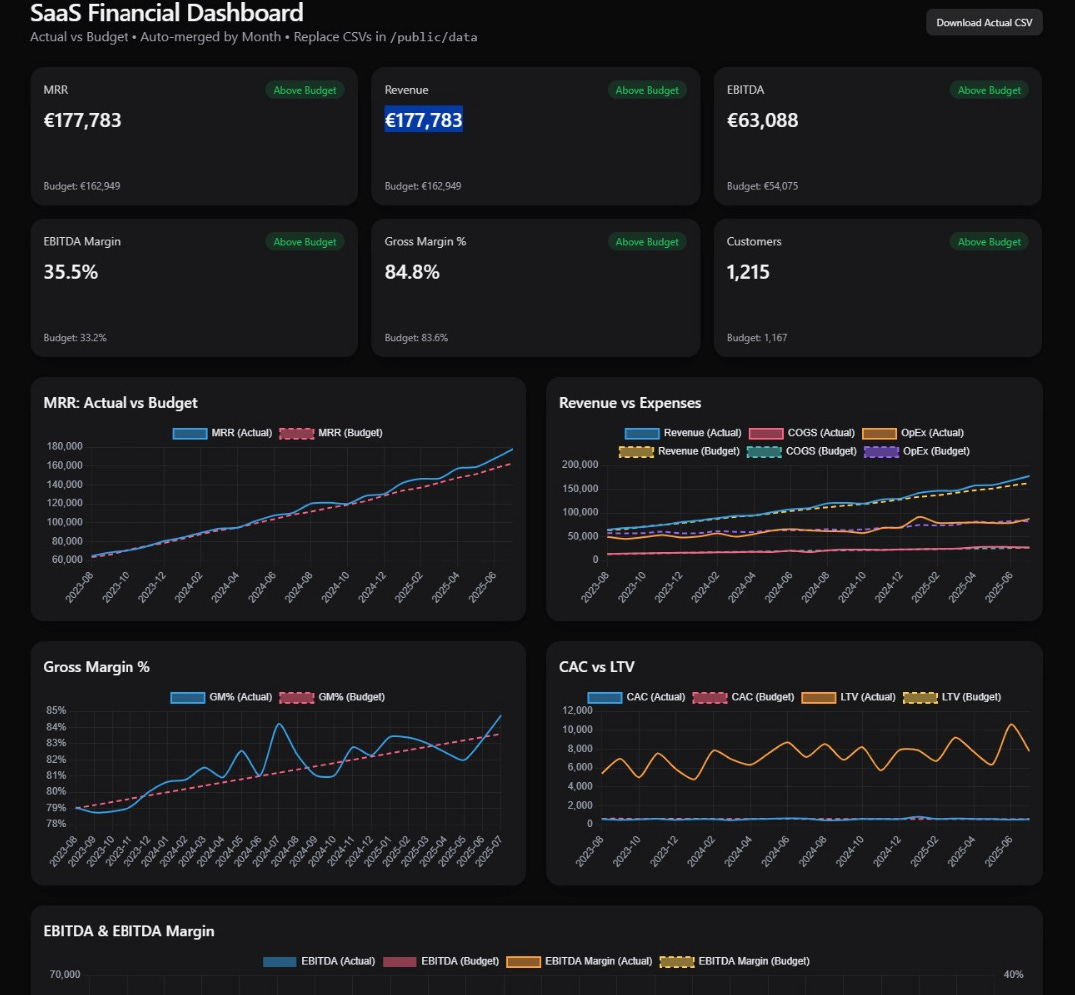

1. I built a SaaS dashboard from scratch

With just 2 CSVs, actuals and budget. GPT-5 combined them and calculated MRR, ARR, EBITDA, gross margin, CAC, LTV, growth rates, Rule of 40…

Then built KPI cards with 12-month sparklines, red/green budget variance, and full trend charts. It zipped the app, and I deployed to Netlify with one click.

You can see the full dashboard here.

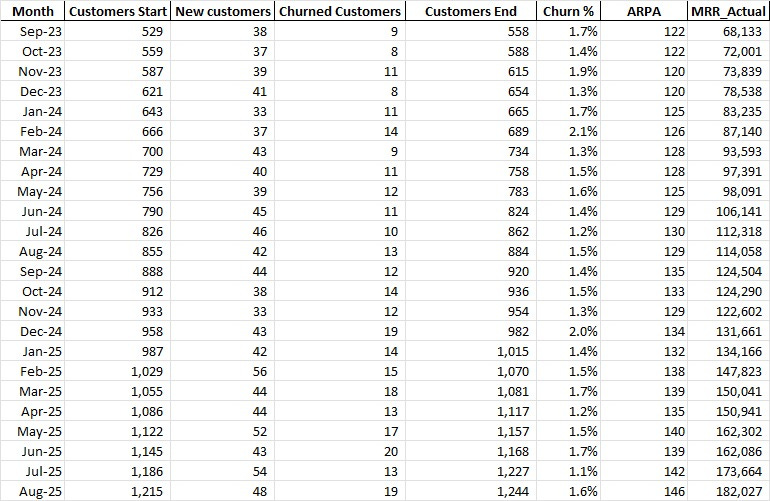

2. A driver-based MRR forecast

I pasted a simple table: new customers, churn, and ARPU. Told GPT-5 to statistically forecast some drivers and hard-set others. It built the forecast, picked the right method for each driver, and explained its reasoning.

Both ran in Thinking Mode, GPT-5’s deep reasoning setting for multi-step analysis.

If you’re a CFO still on the sidelines, someone else is already closing the books, forecasting, and preparing board decks at 10x your speed.

I’ll share with you the full prompts and walk you through so you can build and see the power of GPT-5 in finance.

Let’s dive in.

How To Build A driver-based MRR forecast

Imagine you run a SaaS company with a standard MRR waterfall. Every month, you win new customers, lose some to churn, and earn a set average revenue per customer (ARPU).

From those three inputs, you calculate your Monthly Recurring Revenue.

These are the real growth drivers:

New customers

Churn

ARPU

Here’s where GPT-5 comes in:

You can tell it to forecast each driver differently. Just like a seasoned FP&A analyst would. Some drivers can be statistically projected using methods like exponential smoothing. Others can be set as hard expectations based on known business plans.