The end of finance jobs

The biggest opportunity for finance in 2026.

JPMorgan has over 700 open jobs related to artificial intelligence.

Morgan Stanley built a firmwide AI team to drive a human-centric approach.

Companies just stopped hiring Excel jockeys.

They are hiring people who can leverage AI.

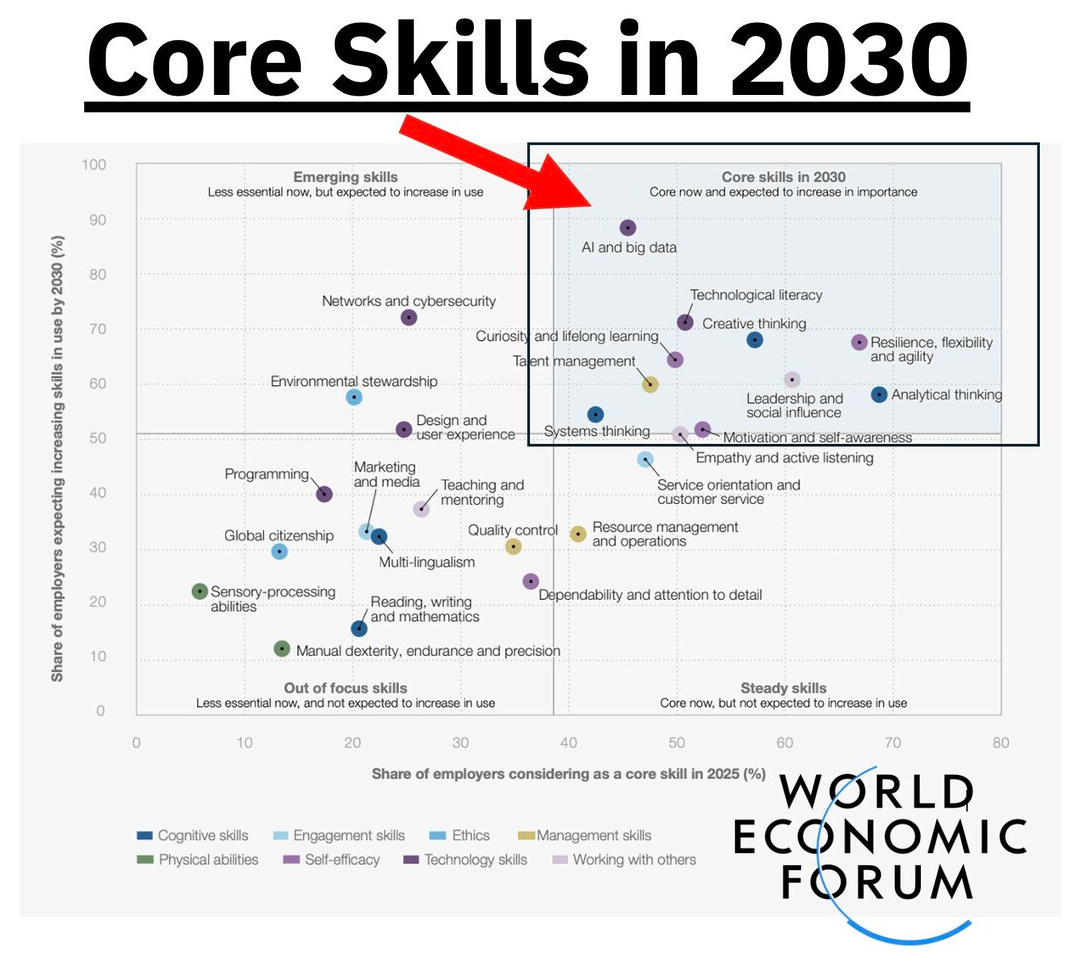

Your future value is not in your technical skill.

It’s in your human skill.